In the present computerized age, the manner in which we deal with our funds has developed fundamentally, with charge cards arising as a favored strategy for ordinary exchanges. Not at all like Visas, have which permitted clients to get cash up to a specific cutoff, charge cards work with exchanges by straightforwardly getting to the assets accessible in the cardholder’s financial balance. This quick admittance to reserves offers various advantages that take special care of the advanced way of life of accommodation, security, and monetary obligation. In this conversation, we will dig into the upsides of utilizing charge cards for ordinary exchanges, featuring their comfort, planning benefits, security highlights, and more extensive monetary administration benefits.

Comfort:

Moment Admittance to Assets: Charge cards permit clients to get to their accessible assets immediately, dispensing with the need to convey money or trust that exchanges will clear. Wide Acknowledgment: Charge cards are generally acknowledged all things considered shippers, including on the web retailers, making them a helpful installment technique for different exchanges.

Contactless Installments: Many check cards presently offer contactless installment choices, empowering speedy and secure exchanges with only a tap or wave of the card.

Planning Benefits:

Constant Following: Charge card exchanges are promptly reflected in the client’s ledger, giving continuous reports on spending and assisting people with following their costs all the more really.

Keeping away from Obligation: Since check cards draw reserves straightforwardly from the client’s financial balance, there is no gamble of collecting obligation or interest charges, advancing dependable ways of managing money.

Financial plan Control: Charge cards can be connected to planning applications or internet banking stages, permitting clients to set spending limits, arrange costs, and gain experiences into their monetary propensities.

Security Highlights:

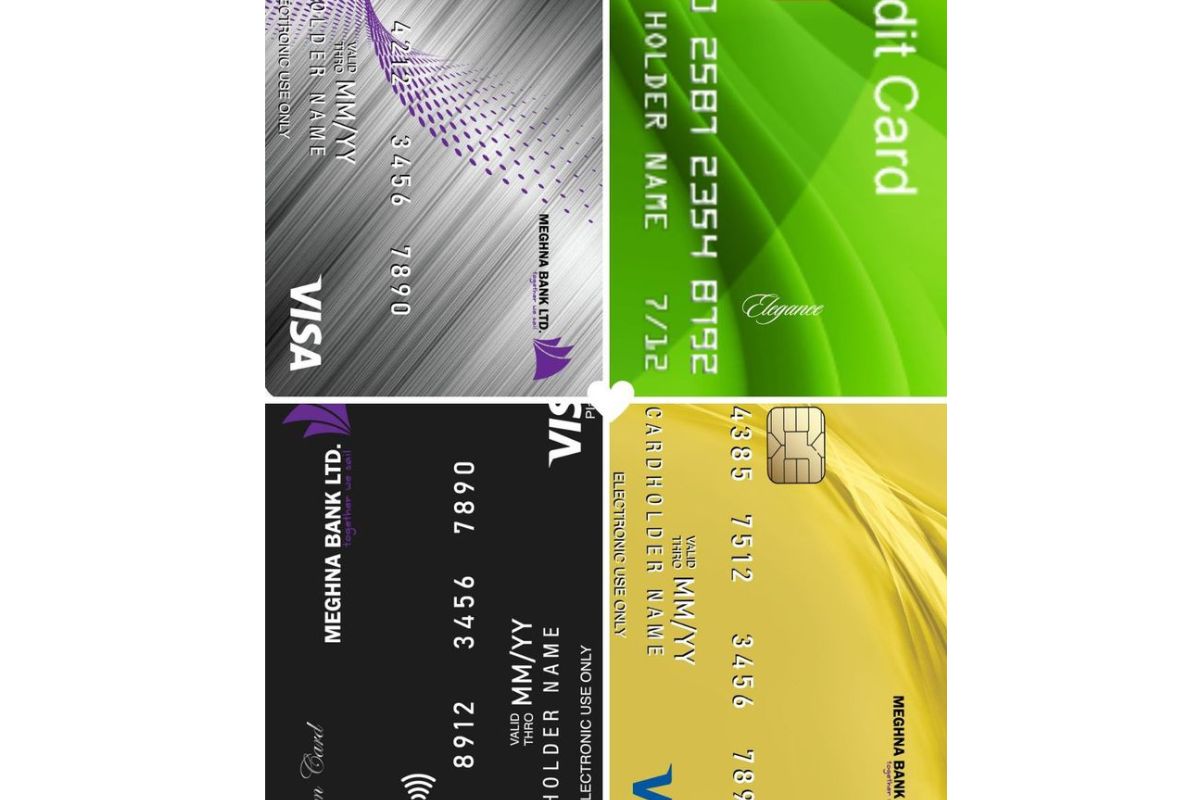

Extortion Insurance: Charge cards frequently accompany security highlights, for example, EMV chips, PIN codes, and misrepresentation checking frameworks to protect against unapproved exchanges and fraud.

Restricted Responsibility: if there should be an occurrence of fake movement, most check card guarantor’s offer restricted risk security, guaranteeing that cardholders are not considered answerable for unapproved charges past a specific breaking point.

Prompt Freeze: On the off chance that a charge card is lost or taken, clients can rapidly freeze or deactivate the card through their versatile banking application or by reaching their monetary establishment, forestalling unapproved use.

Monetary Administration Advantages:

No Premium Charges: Dissimilar to MasterCard’s, which gather interest on remarkable equilibriums, check cards permit clients to spend just the assets they have accessible, staying away from interest charges and advancing monetary discipline.

No Yearly Expenses: Charge cards regularly don’t have yearly charges related with them, making them a practical installment choice for ordinary exchanges.

Direct Store: Numerous businesses offer direct store choices, permitting workers to accept their checks straightforwardly into their ledgers connected to their charge cards, smoothing out the finance cycle and guaranteeing convenient admittance to reserves.

In general, the utilization of charge cards for regular exchanges offers various advantages, including accommodation, planning benefits, upgraded security highlights, and more extensive monetary administration benefits, making them a key device for current monetary exchanges.

The advantages of utilizing check cards for ordinary exchanges are huge and assume a significant part in present day monetary administration. Probably the main benefits include:

Convenience: Check cards offer unmatched comfort by giving moment admittance to assets without the need to convey cash. They are broadly acknowledged at different shippers, including on the web retailers, making them a helpful installment choice for ordinary buys.

Budgeting Control: Check cards work with better planning control by permitting clients to follow their costs progressively. Since exchanges are straightforwardly connected to the client’s ledger, it’s simpler to screen spending and adhere to a financial plan, advancing monetary obligation.

Security: Security elements, for example, EMV chips, PIN codes, and extortion checking frameworks offer hearty assurance against unapproved exchanges and fraud. The prompt freeze choice in the event of misfortune or burglary adds an additional layer of safety, guaranteeing genuine serenity for cardholders.

Avoidance of Debt: Not at all like MasterCard’s, which can prompt obligation gathering and premium charges, check cards just permit spending inside the accessible assets in the client’s ledger. This assists people with abstaining from overspending and amassing obligation, encouraging monetary wellbeing and security.

Cost-Effectiveness: Check cards regularly don’t accompany yearly charges, making them a financially savvy installment answer for ordinary exchanges. Clients can partake in the advantages of electronic installments without agonizing over extra charges.

Direct Store and Convenient Admittance to Funds: Numerous businesses offer direct store choices, permitting workers to accept their compensations straightforwardly into their ledgers connected to their charge cards. This guarantees convenient admittance to assets without the problem of actual checks or postponements.

In general, the significance of utilizing check cards for ordinary exchanges lies in their capacity to give comfort, security, planning control, and monetary soundness. They act as fundamental devices for overseeing funds effectively in the present advanced world.

Unquestionably! How about we describe the advantages of utilizing check cards for ordinary exchanges:

Convenience:

Prompt Access: Check cards offer moment admittance to reserves, permitting clients to make buys helpfully without the requirement for cash.

Wide Acknowledgment: Check cards are broadly acknowledged at different traders, including on the web retailers, making them a helpful installment choice for ordinary exchanges.

Contactless Choices: Many charge cards support contactless installments, empowering fast and bother free exchanges with only a tap or wave of the card.

Budgeting Control:

Ongoing Following: Check card exchanges are promptly reflected in the client’s ledger, working with continuous observing of costs and better

Planning.

Spending Cutoff points: Clients can set spending limits on their check cards, assisting them with remaining affordable for them and abstain from overspending.

No Obligation Amassing: Charge cards just permit spending inside the accessible assets in the connected ledger, keeping clients from collecting obligation and advancing monetary discipline.

Security Features:

Misrepresentation Insurance: Check cards accompany security elements, for example, EMV chips, PIN codes, and extortion observing frameworks to defend against unapproved exchanges and fraud.

Prompt Freeze: if there should arise an occurrence of misfortune or robbery, clients can rapidly freeze their charge cards through versatile banking applications or by reaching their monetary foundation, forestalling unapproved use.

Restricted Obligation: Most check card backers offer restricted risk insurance against deceitful exchanges, guaranteeing that cardholders are not considered answerable for unapproved charges past a specific cutoff.

Financial Management:

Cost-Viability: Check cards commonly don’t have yearly expenses related with them, making them a financially savvy installment answer for regular exchanges.

Direct Store: Numerous businesses offer direct store choices, empowering workers to accept their pay rates straightforwardly into their financial balances connected to their charge cards, guaranteeing convenient admittance to reserves.

Straightforward Exchanges: Charge card exchanges are straightforward and detectable, furnishing clients with definite records of their spending, which can support monetary preparation and the board.

In synopsis, the advantages of utilizing charge cards for regular exchanges incorporate comfort, planning control, security highlights, and monetary administration benefits, making them crucial apparatuses for advanced monetary exchanges.

Conclusion:

All in all, the advantages of utilizing charge cards for ordinary exchanges are complex, taking special care of the requirements of current customers in different parts of monetary administration. Charge cards offer unmatched comfort, permitting clients to get to reserves in a split second and make buys helpfully at a large number of vendors, including on the web retailers. The capacity to follow costs continuously advances better planning control, assisting people with remaining inside their monetary cutoff points and stay away from obligation aggregation.

Besides, the security highlights implanted in charge cards, for example, EMV chips, PIN codes, and misrepresentation checking frameworks, give strong assurance against unapproved exchanges and wholesale fraud. The choice to freeze the card in the event of misfortune or burglary adds an additional layer of safety, guaranteeing true serenity for cardholders. Also, the restricted obligation assurance presented by most charge card guarantors further improves security for clients.

From a monetary administration viewpoint, charge cards are practical, commonly without yearly expenses, and proposition straightforward and discernible exchanges, helping clients in monetary preparation and the executives. Direct store choices given by businesses empower opportune admittance to reserves, smoothing out the finance cycle and upgrading comfort for workers.

Fundamentally, the advantages of utilizing charge cards for regular exchanges highlight their significance as crucial apparatuses for advanced monetary exchanges. Whether it’s for comfort, security, planning control, or monetary administration, check cards offer various benefits that take special care of the different necessities of customers, going with them a favored decision for overseeing funds in the present computerized worlds.

How really do check cards advance planning control?

Check cards work with planning control by giving ongoing following of costs and restricting spending to the accessible assets in the connected financial balance, hence forestalling overspending And obligation amassing.

What security highlights really do check cards offer?

Check cards accompany security elements, for example, EMV chips, PIN codes, and misrepresentation observing frameworks to defend against unapproved exchanges and fraud, guaranteeing inner serenity for cardholders.

Leave a Reply